At Vodafone, we’ve implemented the Inrisk web platform three years ago in cooperation with “Skhid-Zakhid” insurance company and it has been a game-changer for our operations.

The platform’s intuitive design and robust functionality have significantly streamlined our operations, making processes more efficient and user-friendly.

INRISK has enabled us to optimize our workflow, improve customer service, and enhance overall productivity.

Unlock the full potential of your insurance business with Inrisk

Inrisk is an advanced cloud-based Policy Administration System delivering operational efficiency & agility through end-to-end automation of insurance policy management.

Upgrade your business performance,

leveraging benefits of business processes automation with Inrisk:

Faster time to market & productivity improvement

Increasing operational agility

Seamless unlimited scaling of your insurance business

Operational optimization & expenses decrease

Customer experience improvement

Customer's testimonials

Inrisk features digitalize key business processes to reach the next level of operational efficiency

-

Easy insurance product configuration:

Tailor your insurance offerings: set up insurance programs, risks, required documents and adapt to the evolving needs of your business.

-

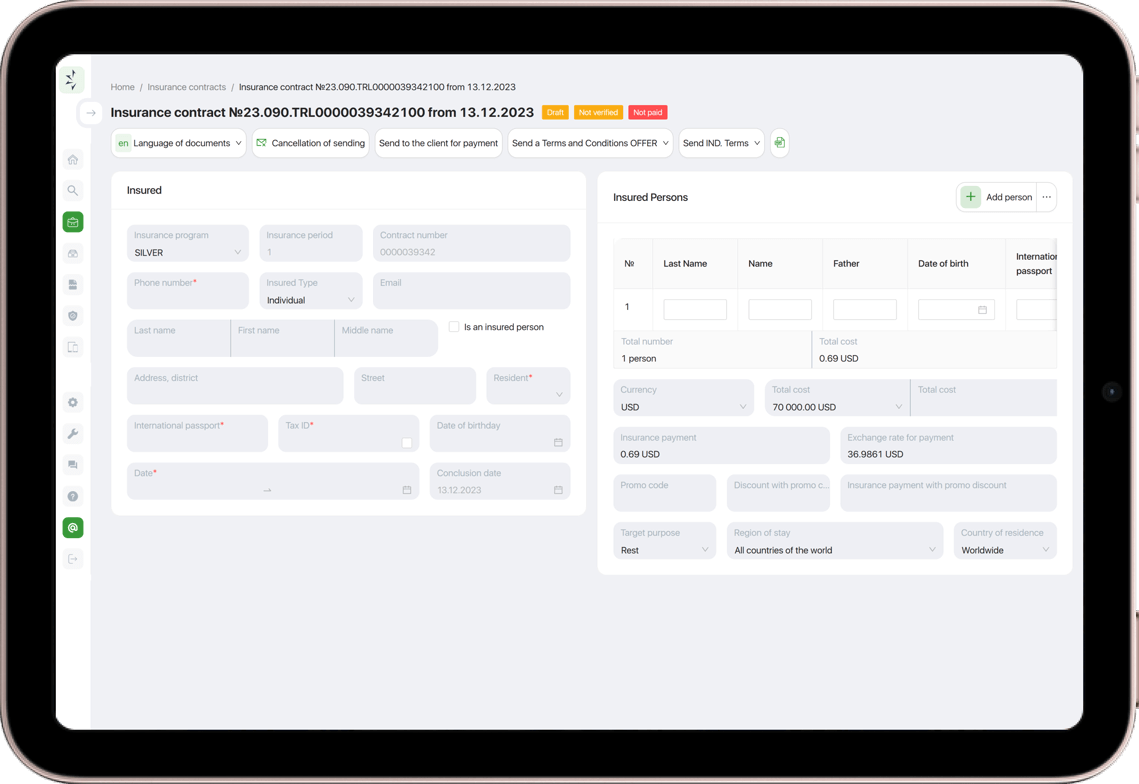

Streamlined policy administration:

Fast and effortless online sales with automated quote calculations.

-

Swift claims management:

Claims workflow with auto claim payment, to provide hassle-free experience for your clients.

-

Agents management and remuneration calculation:

Easily manage roles & accesses among your agents and partners' network.

Agents can instantly see the sum of remuneration in their workspace. -

Efficient billing & finance management:

Manage receivables and payables effortlessly within our paperless workflow.

Securely sign all documents with an electronic key. Leverage secure billing - receive online multi-currency payments and payouts.

-

Analytics and reporting:

Check instant reports on your agents’ and partners’ performance.

Exchange data with other systems through API integrations.

To enhance customer engagement and foster stronger relationships, Inrisk offers access to client’s personal accounts, where customers can check policy details, track their claims, and see other related information.

Inrisk helps to automate the

end-to-end insurance policy lifecycle within paperless workflow

All documents can be securely signed with an electronic key

-

01

Policy administration

-

Automated quote calculation

-

Fast online policy formulation and issuance

-

Secure policy signing with an electronic key

-

Online policy sales by agents or via the internet widget

-

Ensuring remote workstations for your agent network

-

Secure billing of multi-currency online payments

-

-

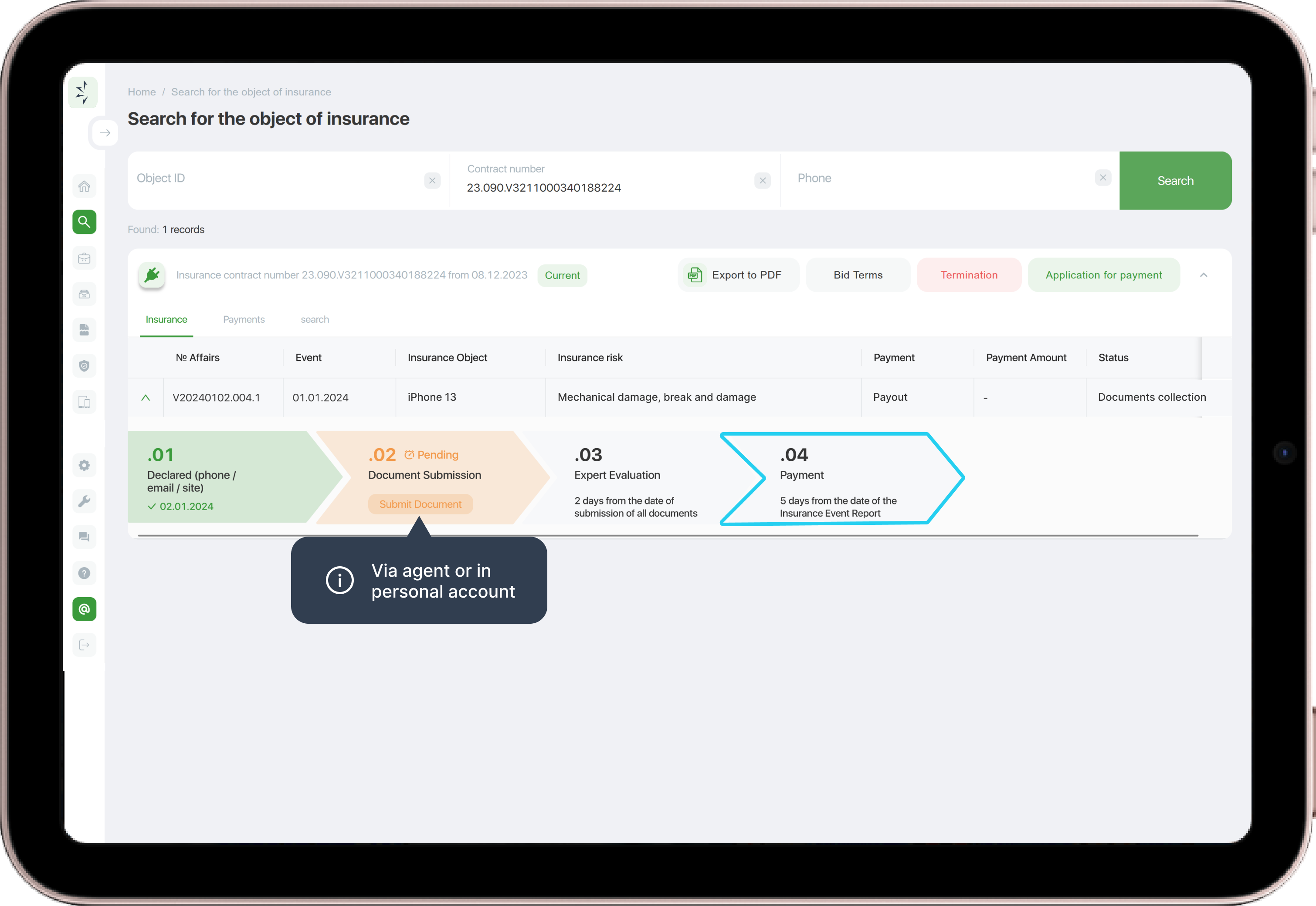

02

Swift Claims management

-

Claims workflow

-

Secure claim submission via an agent or in the client's personal account

-

Auto claim payment

-

Secure billing online payouts

-

-

03

Policy renewal & update

-

Renewal workflow

-

Quick online updates and issuance of policies

-

Secure billing of multi-currency online payments

-

-

04

Policy cancelation

Our clients choose first-class policy management process automation with Inrisk

Deliver the best-in-class customer experience with

Inrisk’s unique feature – swift claims management

Inrisk guarantees a hassle-free experience for your clients, providing claims management workflow with auto payment.

Insurance case occurs

FAQ

-

01

What is insurance policy management software?

Insurance policy management software (policy administration system) is a digital tool designed to help insurance companies efficiently manage and automate various aspects of their policy lifecycle. It streamlines operations, reduces manual workload, and improves accuracy, making insurance processes more efficient and customer-friendly.

-

02

How Inrisk ensure swift claims management?

Inrisk ensures swift claims management through a combination of features and functionalities, such as an automated claims workflow with real-time updates and notifications on claim status in the client's personal account, as well as claims auto payment.

-

03

How does Inrisk ensure business scaling?

Inrisk is an advanced cloud-based policy management software, accessible any time, anywhere. It's capabilities focus on increasing operational efficiency, expanding service capabilities, and improving overall business agility, so you can easily scale your agent network, geographic presence and revenue.

-

04

How does Inrisk improve operational efficiency?

Inrisk is an insurance policy management software, a type of robotic process automation (RPA) solution, designed to streamline and automate various aspects of managing insurance policies, reduce manual workload, and thereby making the processes more efficient and less prone to human error.