Motor insurance

Travel insurance

Medical insurance

Other P&C insurance

Pet insurance

Custom development services upon request

Technology-driven policy management software Inrisk is here to facilitate the hurdles of P&C insurance processes. We prioritize both operational efficiency and customer satisfaction to help you overrun your competition.

Manage your agents & partners network - roles, accesses, remuneration

Configure insurance products - create new and update existing ones

Automate the end-to-end insurance policy lifecycle

Streamline claims management

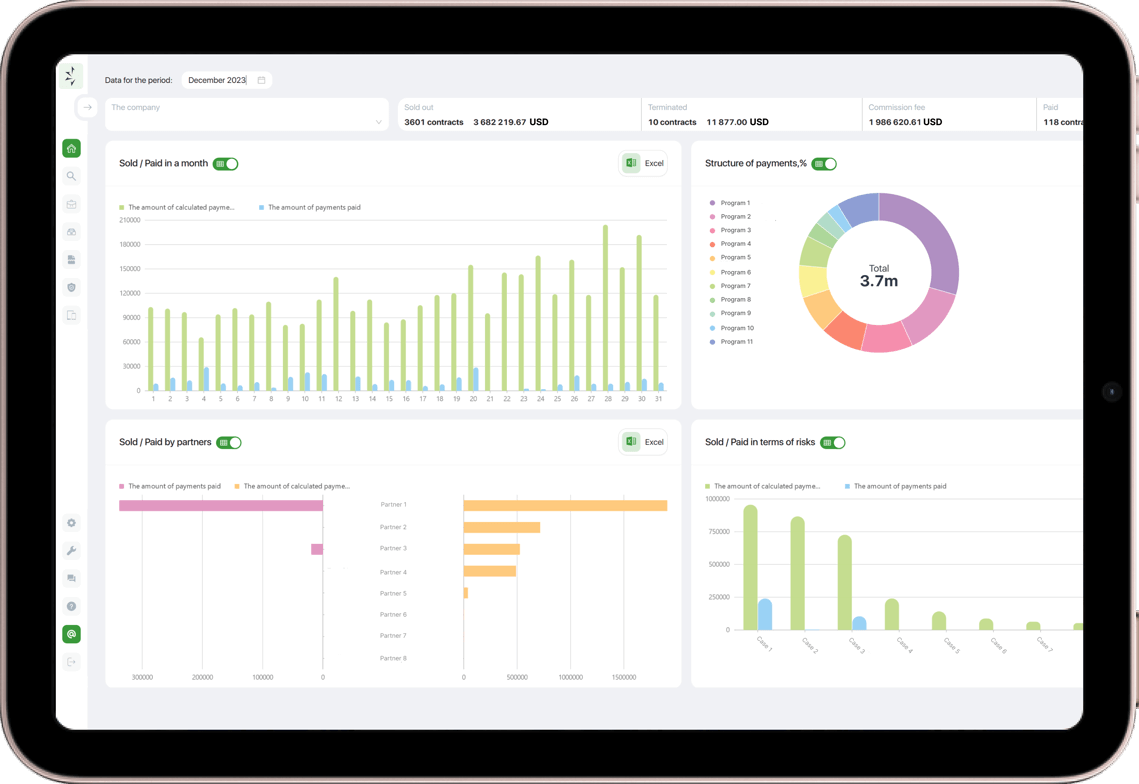

Collect comprehensive analytics and exchange data with other systems

Scale your business effortlessly

Motor insurance

Travel insurance

Medical insurance

Other P&C insurance

Pet insurance

Custom development services upon request

Insurance policy management software (policy administration system) is a digital tool designed to help insurance companies efficiently manage and automate various aspects of their policy lifecycle. It streamlines operations, reduces manual workload, and improves accuracy, making insurance processes more efficient and customer-friendly.

Inrisk ensures swift claims management through a combination of features and functionalities, such as an automated claims workflow with real-time updates and notifications on claim status in the client's personal account, as well as claims auto payment.

Inrisk is an insurance policy management software, a type of robotic process automation (RPA) solution, designed to streamline and automate various aspects of managing insurance policies, reduce manual workload, and thereby making the processes more efficient and less prone to human error.

Inrisk is an advanced cloud-based policy management software, accessible any time, anywhere. It's capabilities focus on increasing operational efficiency, expanding service capabilities, and improving overall business agility, so you can easily scale your agent network, geographic presence and revenue.